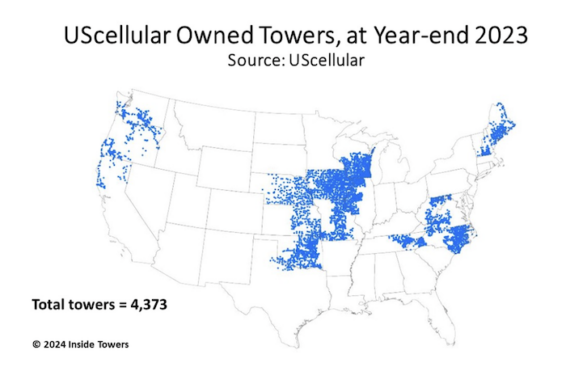

Towers and fixed wireless access are bright spots for UScellular (NYSE: USM). At the end of 2023, UScellular owned and operated 4,373 towers across its 21-state operating area. That figure grew by 37 towers in 2023, a bit more than the 35 towers it added in 2022. Note that the company is the last U.S. mobile network operator of scale to still own towers, according to Inside Towers Intelligence. Full-year tower leasing revenues topped $100 million for the first time, up eight percent on a year-over-year basis.

While UScellular is its own anchor tenant on these towers, the company is actively marketing these sites to attract third party colocations. The company reported 2,390 colocations at the end of 2023, down slightly from 2,401 a year ago. Tower tenancy ratio is 1.55. Each of the Big 3 MNOs are tenants and make up 87 percent of the third-party rentals. T-Mobile accounted for 34 percent, AT&T and Verizon each a little more than 25 percent and the 13 percent balance with other wireless service providers. The Big 3 are also competitors, covering 90 percent of UScellular’s operating territory, according to the company.

FWA is growing as the company deploys 5G. Early FWA deployments used low-band 600/700 MHz spectrum. With C-band spectrum now cleared and new 3.45 GHz licenses in hand, UScellular is offering FWA on these mid-band frequencies. Mid-band FWA delivers low latency and several hundred Mbps download speeds, allowing the company to attract more customers. UScellular reported 114,000 FWA subscribers at year-end 2023, up 46 percent YoY. Still, the company expects FWA to plateau at about 400,000 subscribers in the next several years.

UScellular’s primary mobile service business is under pressure, however, from competing MNOs and cable companies. Service revenues for 2023 were $3.0 billion, down 3 percent from $3.1 billion in 2022, The company incurred net addition losses of 145,000 Postpaid phones and 43,000 Prepaid subscribers for the year. UScellular ended 2023 with nearly 4.6 million retail postpaid and prepaid connections, compared to 4.7 million at the end of 2022.

The company slowed its capital expenditures for the year to $611 million, from $717 million in 2022. Capex was front-end loaded with 34 percent spent in 1Q23, then declining through midyear before upticking in 4Q.

Despite the losses, UScellular made a profit. It significantly reduced its cost of equipment sales. With higher value service plans, Postpaid ARPU grew by two percent YoY to $51.61. Consequently, Adjusted EBITDA grew three percent YoY to $986 million, and net operating income doubled to $139 million, yielding positive cash flows from operating activities.

“In 2023, Postpaid ARPU increased 2 percent, we made significant progress on our 5G network deployment, and we delivered strong results in fixed wireless,” said Laurent Therivel, UScellular President and CEO. “Even though we experienced challenging subscriber results in an aggressive competitive environment, … we were able to drive in profitability year over year. In 2024, we plan to continue focusing on improving subscriber results, driving growth in fixed wireless and towers, and maintaining financial discipline as we advance the network through our mid-band deployment.”

UScellular’s midpoint guidance for 2024 suggests that service revenue, Adjusted EBITDA and capex will all be flat with 2023 levels.

The company offered no update to the strategic alternative review process undertaken by the Boards of UScellular, and parent company Telephone and Data Systems (NYSE: TDS), announced in August, Inside Towers reported.

By John Celentano, Inside Towers Business Editor

Reader Interactions