American Tower (NYSE: AMT) and Crown Castle (NYSE: CCI) are the top two U.S. tower companies. In their respective 2Q20 earnings calls, each detailed strategies and goals for their growth aside from their respective core U.S. tower businesses. You would wonder if they are in the same business at all.

AMT is the largest independent towerco in the world with a portfolio of nearly 180,000 towers in 19 countries. The U.S. portion consists of nearly 41,000 macro towers and rooftops or 23 percent of its global tower base. AMT’s main international tower operations are in Latin America, Africa and India which has the largest count of 75,000 towers.

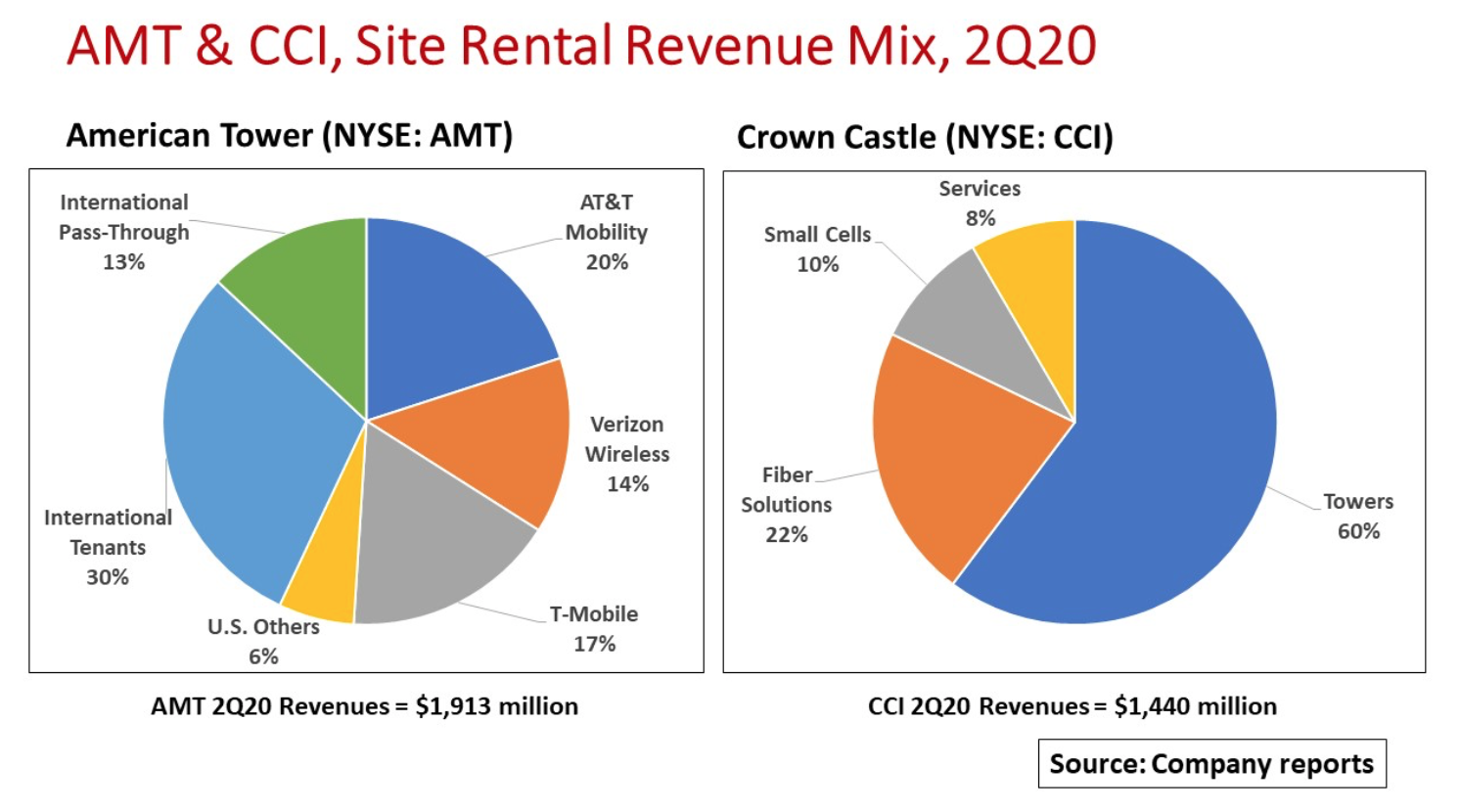

Despite the minor share of towers, the U.S. market generated 57 percent of AMT’s 2Q20 total operating revenues of $1,913 million, up 1 percent from $1,889 million in 2Q19. Of the 43 percent balance, tenant revenues accounted for 30 percent or $574 million on more than 138,000 international towers.

AMT attributed lower international rental revenues per tower to lower price escalators that are tied to inflation rates in countries with soft economies. At the same time, international markets have a lower average occupancy of 1.5 tenants per tower compared to about 2.2 in the U.S. Unfavorable foreign exchange rates also impacted revenues in U.S. dollar equivalencies.

Unlike the U.S. market, however, AMT can pass-through certain operating costs to its tenants. Pass-throughs include a portion of ground leases in Latin America, and fuel and power costs in Africa and India. Pass-through costs amounted to nearly $250 million or 13 percent of 2Q20 revenues.

AMT believes its macro tower model will continue to yield long term payoffs in both the U.S. and international markets.

International carriers continue upgrading their networks to handle greater mobile data traffic volumes and wireless internet access. National governments are supportive of expanded wireless infrastructure to provide greater connectivity for their citizens, especially in those countries where landline service is inadequate.

AMT is budgeting around $1.1 billion in 2020 capital expenditures. This figure includes roughly 6,500 new tower builds in Latin America, Africa and India.

By comparison, CCI operates only in the U.S. At just over 40,000 towers, the company’s macro tower base is roughly equivalent to AMT’s.

CCI’s towers produced $828 million or 60 percent of the company’s $1,440 million in 2Q20 revenues. CCI’s towers have an average occupancy of 2.1 tenants. Site rental revenues were up 4 percent compared to 2Q19.

Pre-construction service revenues were down 34 percent, mainly due to network deployment delays from T-Mobile. Note that both AMT and CCI indicated only minor impact from COVID-19 in the quarter.

CCI believes its long-term growth comes from its diverse infrastructure portfolio with fiber networks and small cells complementing its marco towers, particularly for its major carrier customers deploying 5G.

Today, CCI operates a fiber network of 80,000 route-miles and a base of nearly 70,000 small cells that are either on-air or under construction. While CCI has macro towers across the country, most of its fiber networks and small cell deployments are concentrated in the U.S. Top 30 markets.

The company is investing heavily in its fiber and small cells segment which is projected to absorb $1.2 billion of CCI’s estimated $1.8-2.0 billion capital expenditures in 2020.

CCI points out that similar to the macro tower model, yields on fiber and small cell capital investments will increase over time as carrier networks become denser. This means that with a fiber network in place, new small cells can be co-located on that fiber at an incremental capital cost even as the lease components multiply. Initial deployments are 1-2 small cell nodes but are expected to grow to 10 or more nodes per mile.

Both towercos have interesting strategies for growing their top lines and increasing shareholder value even as they move in completely different directions.

By John Celentano, Inside Towers Business Editor

Reader Interactions