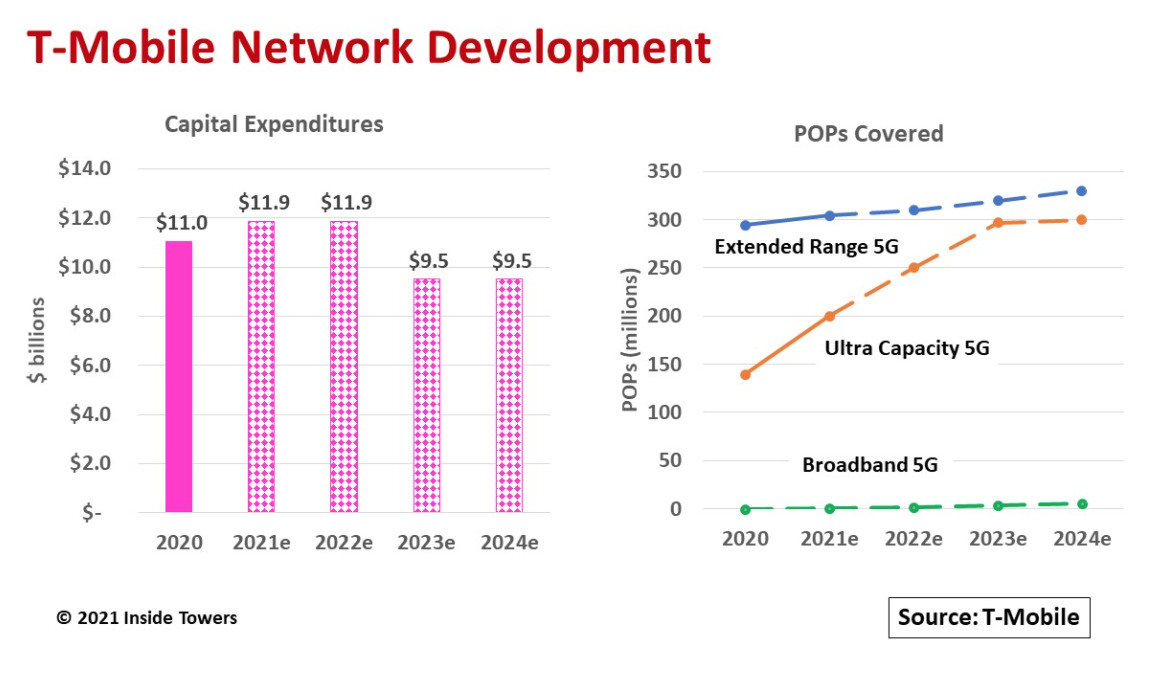

T-Mobile (NASDAQ: TMUS) is confident in its network expansion and integration plans. TMUS’ capital expenditure guidance is a case in point.

The company invested a total of $11 billion in 2020 upgrading and expanding its nationwide network coverage. Capex ramped significantly throughout 2020 starting from April 1, when the merger with Sprint closed.

TMUS is guiding its annual capex in the $11.7-12.0 billion range for both 2021 and 2022. Starting in 2023, it will moderate its spending to $9-10 billion a year through 2025 as it completes its 5G buildout and the Sprint network integration. None of the other carriers are as forthcoming.

Peter Osvaldik, T-Mobile CFO, at a recent Credit Suisse Annual Communications conference, explained the guidance rationale, “… first is to deploy the Sprint [2.5 GHz] spectrum on the T-Mobile anchor network, then it’s to migrate the Sprint customer traffic … onto the T-Mobile network. And then it’s simply decommissioning the cell sites.” He added, “… by the end of this year, we expect now to have 60 percent of the Sprint customer traffic migrated onto the T-Mobile network and 100 percent of that traffic migrated by mid-2022.”

The near-term heavy investments are for its Extended Range 5G that uses low-band 600 MHz as the foundation layer of its spectrum layer cake. Extended Range 5G currently covers 295 million of the U.S. population (POPs), with connections at twice the average speed of the 4G LTE network.

Ultra-Capacity 5G is a high-speed service on the mid-band 2.5 GHz spectrum that came with Sprint. Ultra-Capacity 5G already covers 140 million POPs. TMUS expects it to reach 200 million POPs by the end of 2021 and 300 million POPs by year-end 2023.

TMUS sees opportunities to capture a share of the rural broadband market with both 5G mobility and fixed wireless access. Its estimates that small town and rural community markets consist of nearly 50 million households where TMUS’ share is in the low-teens percentages.

The company plans to grow to 20 percent share with enhanced retail sales through about 1,000 Walmart stores along with “hometown experts,” essentially salespeople without a storefront, to attract new subscribers. TMUS is targeting 7-8 million subscribers in these markets by 2025.

The parallel network builds at 600 MHz and 2.5 GHz along with Sprint network integration, effectively giving TMUS a two-for-one rollout.

In addition, the amount of spectrum devoted to POP coverage is a differentiator. By year-end 2023, TMUS will have 200 MHz of mid-band spectrum, including C-band, across 300 million POPs.

Cell site decommissioning will offset the new site builds. TMUS expects to decommission 35,000 sites by the end of 2022, starting with 7,000 to 8,000 sites in 2021.

Osvaldik explains the network rationalization will yield roughly $3 billion of “hard cost run-rate savings” and about $2 billion of “avoided costs.” Most of the merger synergies will be achieved by 2024.

Once the planned capex is fully deployed, TMUS will end up with 80,000 to 85,000 macro sites, and approximately 50,000 small cells, giving what the company believes is the densest macro network that utilizes the best set of spectrum assets.

The big beneficiaries of carrier network expansion are the tower companies.

Rod Smith, American Tower (NYSE: AMT) CFO, who also participated in the Credit Suisse conference, observes, “We are entering into a period, a multiyear period of probably heightened capex spend from all the carriers, and that heightened capex spend will translate into an increase in activity in the U.S. and we’ve expected that.” TMUS already is AMT’s largest tenant accounting for 20 percent of AMT’s global property revenues in 1Q21.

Smith expects that carrier capex will remain at a heightened level over the next couple of years so they strive to keep up with mobile data consumption demand even as carriers launch and manage their 5G deployments, including the C-band.

He further explained that in addition to monthly rental rates stipulated in a master lease agreement, AMT assesses charges on how the carriers use the towers for deploying new spectrum bands. Any changes related to installing new radio equipment, cables, antennas and lines going up into the towers as well as the deployment cycle, and the timeline, all impact the usage rates that AMT charges.

By John Celentano, Inside Towers Business Editor

Reader Interactions