Presiding U.S. District Court Judge Victor Marrero is weighing pro and con T-Mobile/Sprint merger arguments as he prepares a Go or No/Go decision. Attorneys General (AG) from 14 states are objecting on the grounds that one less major carrier will result in price increases for consumers. The FCC already approved the deal while the Department of Justice (DOJ) gave its approval with the proviso that DISH Network be established as a new fourth national wireless carrier.

A lot is at stake. Next generation wireless services, new wireless infrastructure builds, and customer choice are all hanging in the balance. The real question is: will the merger bring more competition among three, instead of four, national carriers, or less competition because consumers will have fewer choices?

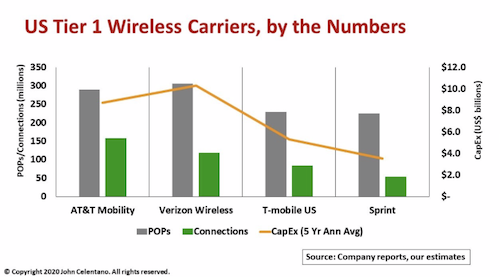

Underlying the AG’s argument is that the current four national carriers are all equal. But a closer look at the numbers shows the four Tier one carriers are not at all on par.

The U.S. wireless industry is more of a duopoly with AT&T Mobility (AT&T) and Verizon Wireless (VZW) going head-to-head as the clear market leaders, T-Mobile as a pesky second-place contender and Sprint as a third also-ran. A group of 30 smaller, regional carriers led by U.S. Cellular provide wireless services in small town and rural areas where the Big four do not.

Consider network coverage. Out of a U.S. population of roughly 327 million people, AT&T and VZW networks each cover about 300 million POPs, or 90 percent of the population. Of those POPs, as of 3Q19, AT&T has 162 million connections consisting of prepaid, postpaid, and reseller subscribers along with 62 million connected IoT devices and vehicles. VZW reports 118 million retail subscribers of all types. By contrast, T-Mobile and Sprint networks cover 225-230 million POPs or just 70 percent of the U.S. population. In their 3Q19 results, T-Mobile reported 84 million subscribers and Sprint followed with a 54 million tally.

Capital expenditures (capex) is another key disparity. We calculated the average of each carriers’ network investment over the past five years, from 2015 through 2019. VZW was the big spender averaging $10 billion a year while AT&T spent nearly $9 billion annually over that period. Compare that to T-Mobile’s $5 billion annual average, while Sprint spent under $4 billion a year over the same period.

T-Mobile and Sprint contend a merged entity would create a strong third competitor. The combination would yield a customer base of over 130 million subscribers and annual capex in the $8-10 billion range to keep pace with AT&T and VZW. Moreover, with broad spectrum access across low-, mid- and high-band frequencies and financial support from Germany’s Deutsche Telekom and Japan’s Softbank, respectively, the “New T-Mobile” will accelerate 5G deployments to challenge the market leaders on technology, services and price. At that point, a true competitive wireless market arises.

If the deal collapses, T-Mobile is prepared to go it alone while Sprint says it may revert to regional carrier status.

Establishing DISH as a fourth national wireless network is a long shot. Even with a $10 billion pot, new spectrum and nearly nine million BOOST Mobile subscribers from the merger, DISH quickly will find it is up against the size and scale of established players that spend nearly that much annually. DISH would be the equivalent of a regional wireless carrier at best.

Those are the facts. Judge Marrero will hear final arguments from both sides on January 15. Stay tuned!

John Celentano is Inside Towers’ Contributing Analyst. He can be reached at [email protected]

by John Celentano, Inside Towers’ Contributing Analyst

Reader Interactions