COVID-19 has imposed severe restrictions on the way we interact with each other both in social settings and in the workplace.

Through the pandemic, “Working From Home” has become the norm for many workers who can perform their job duties remotely and online.

A new survey from iGR (www.igr-inc.com) puts some metrics around how workers have responded to the new norm and their expectations for returning to an office environment.

In October, iGR conducted a survey of over 1,000 U.S. mobile consumers comprising a balanced mix of age and income across urban, suburban, and rural markets.

Key findings show that the number of people who work from home on a full-time and part-time (at least one day per week) basis rose from 35 percent pre-COVID to over 59 percent today.

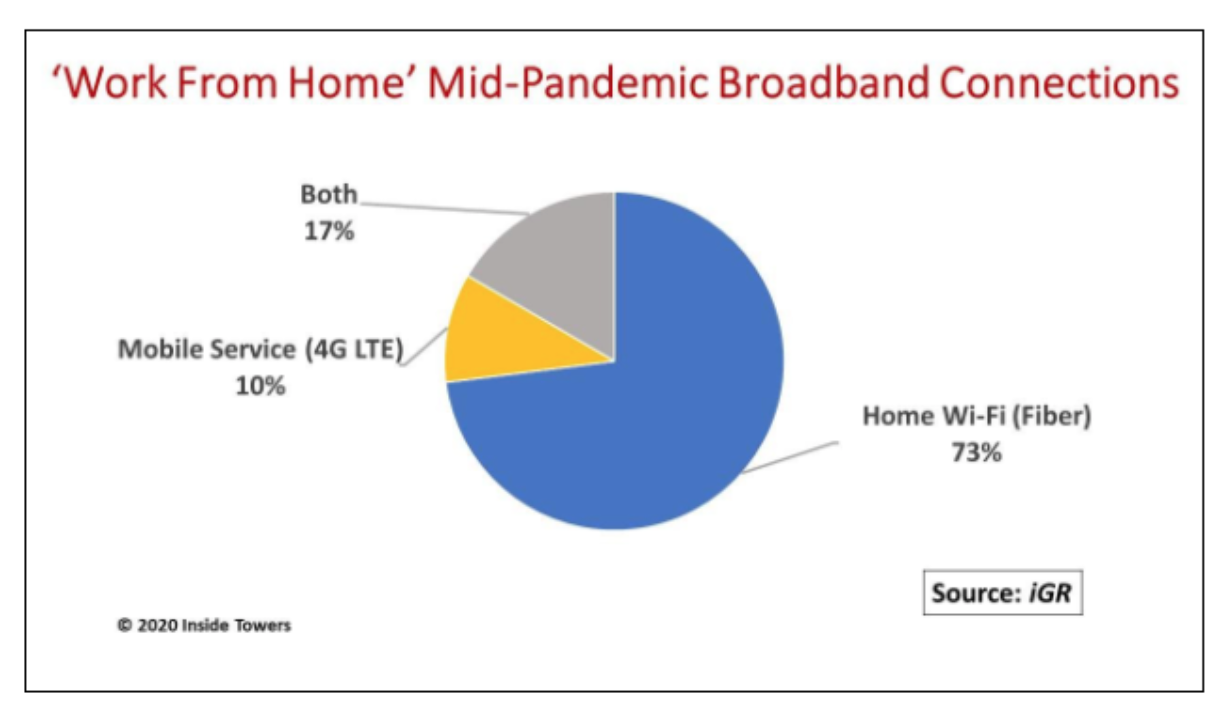

Of the WFH population, 73 percent use their home WiFi, typically through a cable or telco fiber-fed facility, as their primary means to stay connected. Another 10 percent said they rely solely on their mobile service, mainly 4G LTE, while the remaining 17 percent utilize both.

Respondents indicated an overall high satisfaction rate with their internet service with 86 percent saying they were “Very Satisfied” or “Satisfied” with the broadband connections from their wireline or wireless service providers.

More than half of the respondents said that their employers pay for part or all of their mobile and home internet bill, and about half of those said their employers furnished mobile phones, laptops or other computing devices to use for their work activities. On the other hand, 42 percent indicated they receive no financial support from their employers for these internet services.

Returning to the pre-COVID workplace is a mixed bag, however.

Roughly 44 percent indicated that their company has already opened or partially opened (some employees work in the office part of the time). Another 21 percent said their company plans to open the office either by the end of 2020 or early 2021 while 8 percent expect their company to reopen by mid-2021.

Yet 25 percent of respondents said that their company either has not shared a return to work plan or does not ever plan to open an office again.

These survey findings have big implications for where and when new wireless and fiber infrastructure may be deployed.

In the past, busy-hour traffic reached peak levels during the day mainly in downtown core or business parks then shifted to residential areas in the evenings.

That is no longer the case. Peak busy hours are evident in residential areas all day long with little or no internet traffic in or out of many downtown areas.

Consequently, we may see in the near-term (in the next 12-24 months), a deferral of carrier capital expenditures that had been planned for network densification in metro areas. Instead, that capex likely will be diverted to coverage and capacity expansion, especially with 5G and fiber, in suburban areas.

Expect that carriers will extend infrastructure investments into small town and rural markets where WFH has a lot of appeal due to an overall lower cost of living and not having to navigate metro rush-hour commutes. Certainly, WFH with high-speed broadband connectivity can be a catalyst for economic growth in these markets.

Carriers likely will enhance broadband connectivity for WFH first in suburban areas surrounding big cities with a mix of fiber-to-the-premise, and wireless small cells operating on millimeter wave frequencies and low- or mid-band macrocell sites on towers. By extension, WFH outside of metro areas will be served by both FTTP and macrocells supporting low- and mid-band RF transmissions.

Over the longer term (3-5 years), capex likely will shift back to metro areas as the number of people living and working in cities gradually reverts to or even exceeds pre-COVID levels. As that happens, capex will go towards network densification with small cells on street furniture and in-building wireless deployments.

“Mobile operators generally plan their networks more than 12 months ahead. Reacting quickly to short term traffic shifts is very difficult, if not impossible,” says Iain Gillott, iGR President. “So understanding how many people will not return to the office in the next three years is very important.”

There should be no delusion that the pandemic has caused some permanent dislocations.

With available broadband technologies and service provider choices, along with people’s desire for flexible work arrangements, the survey results suggest that as much as 30 percent of the workforce may never go back to pre-COVID work environments.

By John Celentano, Inside Towers Business Editor

Reader Interactions