This is an excerpt from the upcoming issue of Intelligence by Inside Towers

Subscribe today for access to industry data and insights

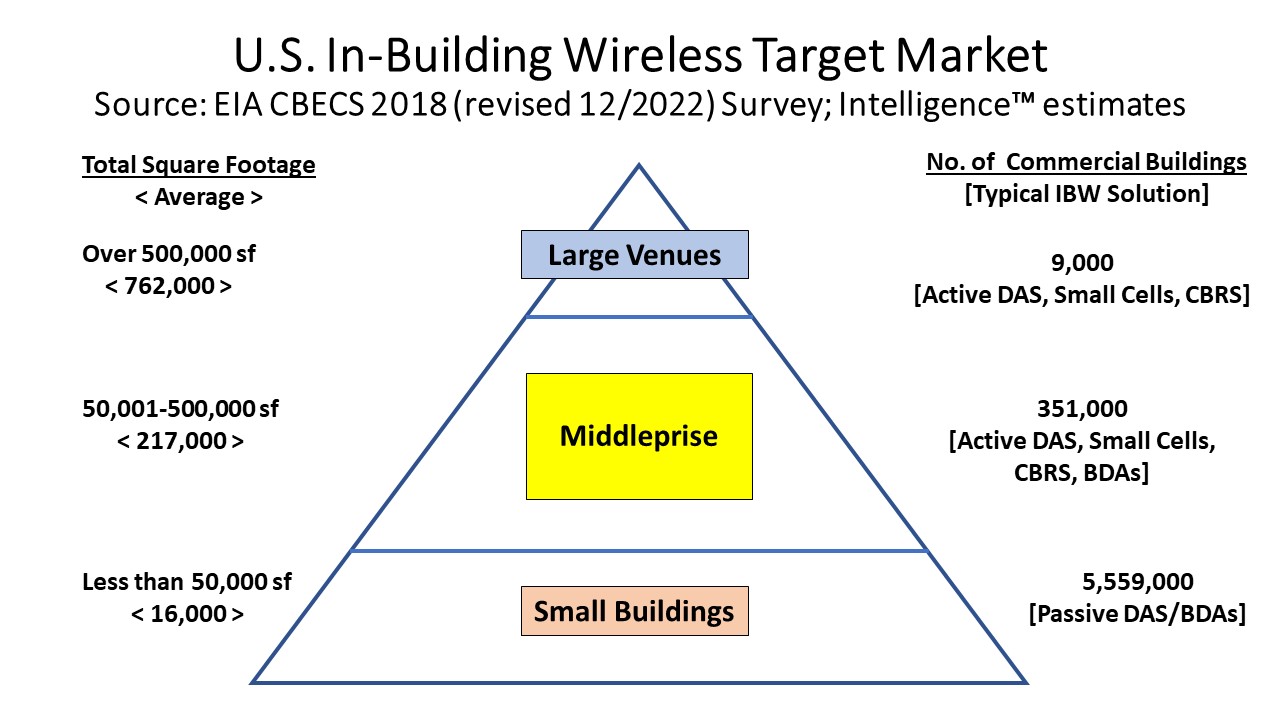

There are over 5.9 million commercial buildings in the U.S., according to the Energy Information Administration’s Commercial Buildings Energy Consumption Survey (EIA CBECS), part of the Department of Energy. An oft-cited wireless statistic credited to the former AT&T Antenna Systems Group is that roughly 80 percent of all mobile voice and data calls originate or terminate inside buildings. With so many buildings, there is a massive challenge for mobile network operators and building owners alike to ensure that wireless signals can be transmitted and received inside these buildings.

The middle tier of buildings is the most interesting segment. It offers the best opportunity for vendors and contractors from an in-building wireless (IBW) perspective. Dubbed by industry analysts as the ‘Middleprise’ (a play on words from Middle Enterprise), this segment is a mix of high-rise office and residential buildings, educational campuses, hotels, healthcare facilities (hospitals/medical centers), shopping malls and warehouses. The Middleprise accounts for nearly 6 percent of the total count, comprising 351,000 buildings in the 50,001-500,000 sq ft range, with an average of 217,000 sq ft.

Most of the time, when we use our mobile phone inside a building, we actually connect to a nearby tower. This works fine with small buildings. In large buildings, this can be a problem. Outdoor cellular signals do not reach very far inside big buildings. How many times have you had to stand by a window to make a call or even check for messages?

The problem is that most building materials are not wireless-friendly. Steel, concrete, and energy-saving glass windows attenuate or block outside RF transmissions from moving through the building if these signals get inside at all. Moreover, special use areas like elevator shafts, underground parking garages and interior walls obstruct or degrade wireless connections.

On top of the commercial considerations for in-building wireless is the imperative for public safety communications. In case of an emergency, building occupants must be able to make 911 calls and texts with location accuracy and receive mobile mass notifications, and first responder communications must just work.

Many buildings already have a shared public WiFi system but with limited coverage and capacity and generally not secure.

Distributed antenna systems (DAS) have proven to be the best technology platform for delivering multiple MNO signals inside buildings. IBW costs for a particular building are determined by the building size and layout, prevailing building codes, how is the building being used and where coverage is needed most, number of mobile and fixed devices being served, traffic patterns (day/night, weekdays/weekend), single or multiple carrier signals to be transmitted indoors along with other site-specific considerations.

Hardware (transmission equipment, antennas, cabling) is the biggest cost component. However, associated services (system design and engineering, installation and post-installation operations) are significant as well.

With deployment costs averaging $1-2 per sq ft for buildings in the 100,000-500,000 sq ft range, we estimate that the Middleprise market will grow at a 13 percent CAGR with thousands of buildings being outfitted over the next three years reaching a market value of around $1.4 billion by 2025.

A detailed IBW market analysis and forecast is available in the latest Intelligence 2023 Volume 1 issue. For more information, or to subscribe, visit: www.insidetowers.com/intelligence.

By John Celentano, Inside Towers Business Editor

Reader Interactions